Conversion Cost Definition, Formula, How to Calculate?

Labor is sometimes a little more complicated to define because, for many companies, the contributions of several different types of employees are crucial to the creation of the end product. However, the definition of a labor expense used in https://www.bookstime.com/articles/percentage-of-sales-method the prime cost formula includes wages paid only to those employees who directly participate in the building, formation, or assembly of an item for sale. The cost of labor and payroll taxes used directly in the production process are part of prime costs. Labor that is used to service and consult the production of goods is also included in prime costs.

How to Calculate Conversion Costs

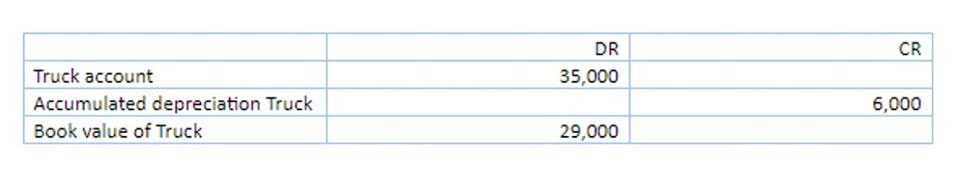

Prime costs are calculated based on the direct labour costs and the total cost of the raw materials. In contrast, conversion costs are focused on the direct labour costs and the costs involved in the indirect factors which affect the manufacturing and production system like electricity, factory insurance, etc. Therefore, once the batch of sticks gets to the second process—the packaging department—it already has costs attached to it. In other words, the packaging department receives both the drumsticks and their related costs from the shaping department. For the basic size 5A stick, the packaging department adds material at the beginning of the process.

Manufacturing Cost

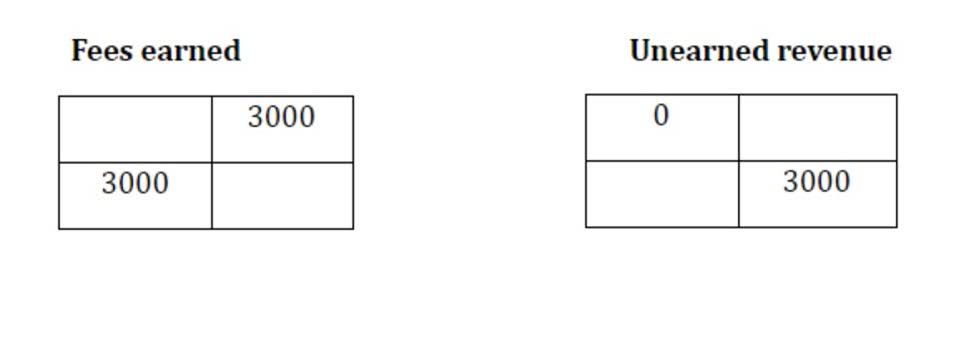

For example, if your conversion metric is signing up for your email list, the signup form should be total conversion cost formula prominent. How to assess conversion cost if it is watching a video, the video should be prominent. In manufacturing sector, the basic production costs can be categorized differently depending on the purpose and use of categorization.

Examples of Conversion Costs

- Though the production of goods and services involves many different kinds of expenses, the prime cost formula only takes into account those variable expenses directly connected to the production of each item.

- The computational responsibility lies with the factory manager who collects the relevant data, calculates the prime cost figure for the period and reports the same to operations manager for review.

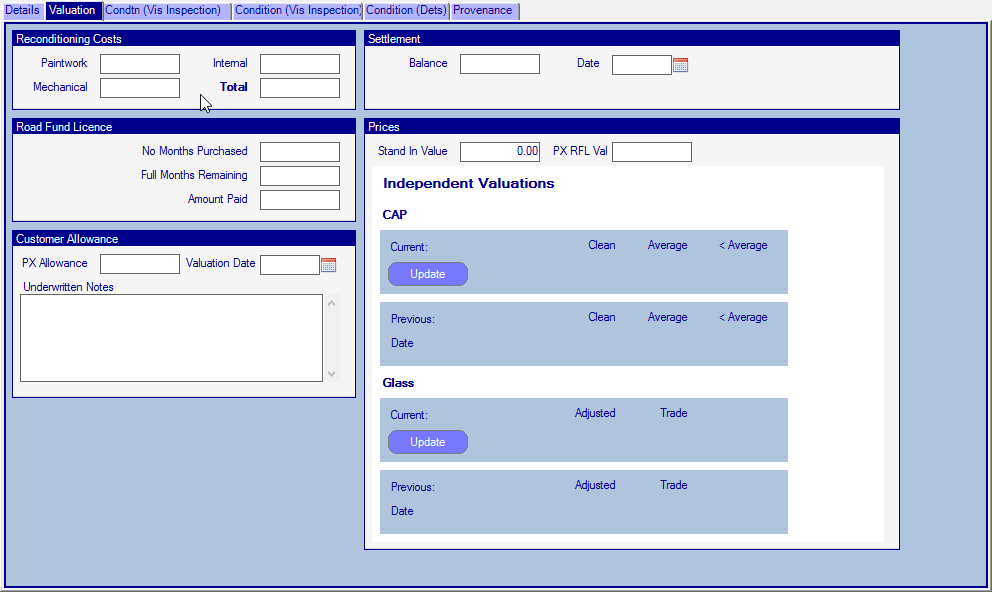

- The Conversion Cost Calculator is an essential tool for manufacturers looking to accurately assess their production costs.

- During June, Excite Company’s prime cost was $325,000 and conversion cost was $300,000.

- Direct materials are one of the main components of prime costs and include raw materials and supplies that are consumed directly during the production of goods.

However, they may also include the cost of supplies that are directly used in production process, and any other direct expenses that don’t fall under direct materials and direct labor categories. As can be seen from the list, the bulk of all conversion costs are likely to be in the manufacturing overhead classification. In a business that uses a high degree of automation, it is likely that manufacturing overhead costs will comprise the bulk of all conversion costs. The calculation for conversion costs includes direct labor in addition to overhead expenses.

Ask a Financial Professional Any Question

Sometimes individuals become managers due to their knowledge of the production process but not necessarily the costs. Managers can view this information on the importance of identifying prime and conversion costs from Investopedia, a resource for managers. In the Peep-making process, the direct materials of sugar, corn syrup, gelatin, color, and packaging materials are added at the beginning of steps 1, 2, and 5. While the fully automated production does not need direct labor, it does need indirect labor in each step to ensure the machines are operating properly and to perform inspections (step 4). Conversion costs are also used as a way to measure the efficiencies in the production processes but they also take into account the overheads in the production process, which are not calculated in prime costs. Generally, a business is looked upon as developing and selling products and earning profits.

Mechanics of Applying Conversion Costs

- For a furniture manufacturer, the raw materials might be lumber, hardware, paint, and varnish.

- Remember that you can define conversion however you want, such as the number of sales and number of operating leverage dol formula + calculator signups for your email list.

- Yes, comparing your conversion costs to industry standards can provide insights into operational efficiency and areas for improvement.

- There are many different accounting formulas that you will be exposed to as a business owner.

- Of course, that is not always possible, such as in the case of shorter advertising campaigns.

- Conversion cost is the cost incurred by any manufacturing entity in converting its raw material into finished goods capable of being sold in the market.

The use of this ratio in process costing is to calculate the cost for both direct labor and manufacturing overheads. It’s important because it will become the cost of the inventory which will impact the selling price. Hence, using conversion costs is an efficient way of calculating equivalent units and per unit costs rather than separately calculating direct labor and manufacturing overheads. No, conversion cost includes only direct labor and manufacturing overhead, while total manufacturing cost also includes raw material costs. Prime costs are all of the costs that are directly attributed to the production of each product. Prime costs are direct costs, meaning they include the costs of https://www.instagram.com/bookstime_inc direct materials and direct labor involved in manufacturing an item.